New and Enhanced Employee Benefits Effective Jan. 1, 2024

Beginning in 2024, Sandia will offer employees the following new and enhanced benefits beyond what was offered through 2024 Open Enrollment.

Eligibility

Non-represented employees currently eligible for standard benefits, e.g., vacation, holiday.

Excludes student interns, recurrent employees, and part-time rehired retirees.

Represented employees should refer to their collective bargaining agreement to verify their benefit options.

New Floating Holidays: Two Days

Two Floating Holidays (16 hours) will be awarded at the start of the calendar year for all employees currently eligible for Sandia holidays. If you are a part-time employee, you will be awarded pro-rated hours based on your standard hours.

You can choose to recognize a day that is significant to you, maybe your birthday, or your niece’s adoption day, or another day that holds meaning to you, and/or that represents values important to you. It is your choice when to use these new Floating Holiday hours but follow your team’s standard time off procedure with your manager. If you are on an Alternative Work Schedule (AWS), you can also use Floating Holiday hours to supplement the additional hours needed on a Sandia observed holiday with the exception of Sandia’s winter shutdown.

All employees may charge TRC 239 Floating Holiday in 1-hour increments.

If you are a non-exempt employee, know that usage of the Floating Holiday does not qualify for holiday pay, nor will it count as time worked.

You are not able to use these Floating Holiday hours beyond the vacation buy usage deadline as indicated on the Payday, Accrual and Holiday schedule, and any unused Floating Holiday hours will roll to your vacation balance and be subject to standard vacation cap rules after that date.

Should you separate from Sandia, and have unused Floating Holiday time, the hours will be rolled to your vacation balance and paid out in your final paycheck, subject to standard vacation carryover and accrual rules. You cannot use the Floating Holiday to extend your separation date once notice has been provided, except for Retirement eligible exhaustion of paid leave, or if you are terminating due to exhausting your Sickness Absence benefits.

Additional Resources

Frequently Asked Questions

Real-world example: Maximizing my Sandia Floating Holidays

New Vacation Accrual Schedule: Increase to Vacation Time

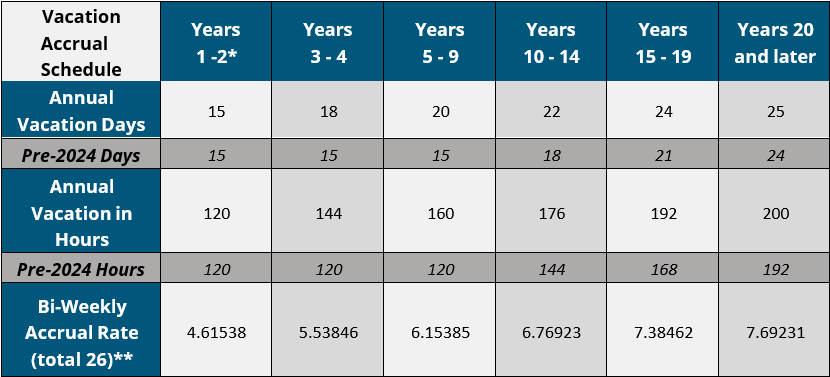

The frequency of your accrual rate increases will expand to a total of six accrual tiers. On Jan, 12, 2024, and forward, your accruals will automatically adjust according to the tier matching your years with Sandia in the chart below. Subsequently, you will receive an increase in your vacation accrual rate after the start of your third, fifth, 10th, 15th, and 20th service year.

*Includes all postdoctoral appointees

**Display of balances on the leave balance page and paycheck will be truncated to two decimals even though the balance is calculated by the system with five decimals. Total annual accruals increased from 24 to 26.

In addition, vacation accruals will change from 24 accruals per year to align with each pay period for a total of 26 accruals per year. This means your bi-weekly accrual rate will be based on the total annual vacation accrual hours according to your specific accrual tier and divided by 26.

Non-exempt employees will continue to charge TRC 241 Vacation in 15-minute increments, and Exempt employees will charge in 1-hour increments.

Additional Resources

Frequently Asked Questions

Vacation and Holiday Accrual Chart – Effective Jan. 1, 2024

New Sandia Childcare Fund: $1,500 for Childcare Needs

Sandia is introducing a Childcare Fund to help employees offset the cost of childcare during business hours. Sandia will fund $1,500 per benefit eligible employee to an account at the beginning of each calendar year. You do not have to elect this benefit during Open Enrollment. However, if you do not cover your dependents through Sandia health benefit programs, you will need to add them to the Dependent/Beneficiary Tile by contacting HR Solutions. Funds will be available as of Jan. 1 by submitting claims through Inspira Financial (formerly PayFlex) for paycheck reimbursement (like the Lifestyle Spending Account). This is considered a taxable benefit under the IRS.

Acceptable expenses include:

- Daycare

- Before and after school care

- Nursery care

- Back up care and sick childcare

- Day camp

- Specialty day camps – i.e., soccer camp, computer camp

- Babysitting/Nanny/Au Pair during work hours/work related

- Includes care provided by a neighbor or family member that is NOT a tax dependent and is 19 years or older

- Fees and deposits

- Includes registration and application fees

- Deposit and registration fees are only reimbursable once the event has started

- Examples:

- Deposit to reserve space at preschool

- Deposit to reserve space at a daycare center

- Application fees for Nanny or Au Pair

- Registration fees for summer day camps

Additional Resources

Frequently Asked Questions

Real-world example: Maximizing my Sandia Childcare Fund

Lifestyle Spending Account (LSA): Expanded Eligible Expenses

Beginning Jan. 1, the list of eligible expenses for the LSA will be a little more expansive and will include items such as music subscriptions, meditation apps and salon/barber services. See the complete list of reimbursable expenses (pdf).

401(k) Plan Enhancements: Student Loan Debt Match

Sandia is modernizing the 401(k) plan to provide more flexibility and support a multi-generational workforce’s financial well-being. Now, Sandia can help employees that find it difficult to pay student loans while saving for retirement.

Starting Jan. 1, eligible federal or private student loan payments that you make directly to your U.S. based loan service provider will be treated the same as employee salary deferral contributions, and you can receive Sandia’s overall matching contribution (66.667% of every dollar up to the first 6%) for the 401(k) plan. This includes your own student debt, as well as cosigned and parent loans for undergraduate or graduate higher education.

Starting now, you will be able to log onto Fidelity’s website to connect your eligible student loans to start tracking your payments.

- There is no need to change your current employee elective 401(k) plan deferral amount(s).

- You will continue to make your on-time student loan payments directly to your loan service provider as you do today.

- Sandia will match your elective employee contributions for every paycheck throughout the year (66.667% of every dollar up to the first 6% of earnings).

- If you contribute 6% or more of your annual earnings to your 401(k) through elective deferrals, you will receive the full eligible matching contribution from Sandia and will not receive any additional match for your student loan payments.

- If you contribute less than 6% of your annual earnings to your 401(k) through elective deferrals, based on your on-time student loan payment history for the calendar year, Sandia will make a lump-sum employer student loan debt matching contribution up to the maximum eligible match in April 2025.

- The student loan matching contributions are subject to normal vesting requirements.

Additional Resources

Frequently Asked Questions

Real-world example: Maximizing my Sandia 401(k) Student Loan Debt Match

Complete your health assessment

Completing an annual health assessment enables you to evaluate your current health status, track progress and identify any potential setbacks. By pairing the health assessment with health coaching, you create a powerful strategy for heightened awareness and actionable steps that lead to improved well-being.